The U.S. Department of Labor (DOL) has rejected the previous six-part test for determining whether interns and students are employees… Read More […]

The U.S. Department of Labor (DOL) has rejected the previous six-part test for determining whether interns and students are employees… Read More […]

Effective January 1, 2018, unless otherwise noted, the following states have made increases to their minimum wage rates: Alaska: Minimum… Read More […]

The Internal Revenue Service has announced cost of living updates for tax year 2018. Highlights of the notices include: The… Read More […]

On July 25, 2017 the U.S. Department of Labor announced an increase to the prevailing health and welfare fringe benefit… Read More […]

Rhode Island has passed a paid sick leave law, effective July 1, 2018. Note that the provisions outlined below serve… Read More […]

Employers who prefer to use per diem allowances to reimburse employees for domestic travel, may use the IRS’s optional ‘high-low’… Read More […]

Effective Immediately – Maine Department of Revenue Services has published revised 2017 Maine Income Tax Withholding Tables to reflect the… Read More […]

Employers that provide prescription drug benefits are required to notify Medicare-eligible individuals annually as to whether the employer-provided benefit is… Read More […]

The Office of Information Regulatory Affairs (OIRA) has announced that EEO-1 reporting for 2017 activity will not include pay data…. Read More […]

The U.S. Department of Labor released memorandum number 225 on July 25, 2017 announcing an increase to the prevailing health… Read More […]

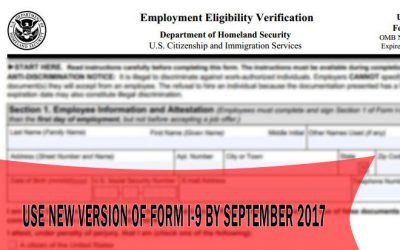

On July 17, 2017, the U.S. Citizenship and Immigration Services (USCIS) released a new version of and instructions for Form… Read More […]

The federal Occupational Safety and Health Administration (OSHA) has released a proposed rule seeking to defer the date by which… Read More […]